Lets Improve Your Credit Score

At Prolific Dynasty Enterprise LLC, we believe that great credit is the foundation of financial freedom. Our expert credit restoration services are designed to not only improve your score — but transform your entire financial outlook.

Step 1: Credit

Repair

The first step to repairing your credit is knowing where you stand. Start by pulling your credit reports from all three major bureaus — Experian, Equifax, and TransUnion. Carefully review them for any errors, outdated information, or fraudulent accounts. Identifying the problem is the key to creating an effective game plan for repair.

Step 2: Credit Growth & Building

Now that you’ve laid the foundation, it’s time to build trust with lenders. Step 2 focuses on making consistent, on-time payments across your credit accounts. This includes credit cards, installment loans, or any reported bills. Timely payments make up 35% of your credit score — the biggest factor — and show you’re reliable and financially responsible. Consistency here is key to growing strong credit.

Step 3: Funding Access To Capital

To access real funding, your business must be set up the right way. This step focuses on making sure your business has a proper legal structure (LLC or corporation), an EIN, a business bank account, a professional website, and matching business details across all platforms. Lenders trust businesses that look credible and organized — structure equals strength.

Step 4: Use Funding

Once you secure capital, it’s time to make it work for you. This step is all about using your funding wisely — whether it's for scaling operations, marketing, building business credit, or investing in income-producing assets. Avoid unnecessary debt and focus on moves that generate ROI. Smart money moves lead to sustainable growth.

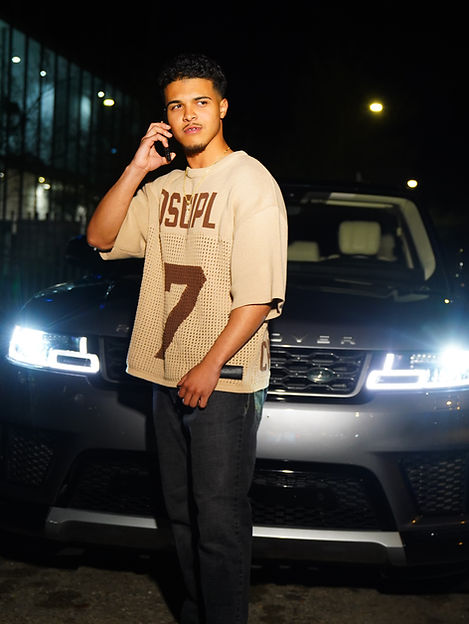

Meet Your Coach

As the founder of Prolific Dynasty Enterprise LLC, I’ve made it my mission to help individuals and business owners break free from financial setbacks and take full control of their credit journey. With years of hands-on experience in credit restoration, business funding, and financial literacy, I don’t just repair credit — I coach you to understand it, maintain it, and leverage it.

I take a personalized and empowering approach with every client. Whether you're rebuilding from past challenges or looking to maximize your credit score for future goals, I’m here to walk with you step-by-step — offering real strategies, honest guidance, and results you can see.

With me as your credit coach, you’ll learn how to:

-

Identify what’s holding your score back

-

Dispute negative and inaccurate items

-

Build and maintain strong credit habits

-

Position your credit for homeownership, business funding, and more

Buisness Funding

At Prolific Dynasty Enterprise LLC, we empower entrepreneurs and small businesses with strategic funding solutions to fuel growth and build legacy. Our business funding services are designed to be fast, flexible, and tailored to your unique goals—because we believe in helping you scale with confidence.

Our Business Funding Services Include:

-

Working Capital Loans

-

Business Lines of Credit

-

Equipment Financing

-

Startup & Expansion Funding

-

Credit Building Consultation

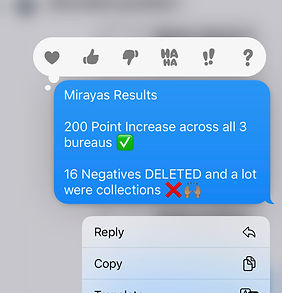

What Our Customers Are Saying

“Prolific Dynasty Enterprise LLC helped me raise my credit score by over 100 points in less than 4 months! I had no idea where to start, but they walked me through every step. Now I’m pre-approved for a home loan and finally in control of my finances. Truly life-changing.”

— Jessica R., Dallas, TX

“I came to Prolific Dynasty looking for funding to grow my trucking business. Not only did they help me secure $75K in capital, but they also showed me how to build business credit the right way. Professional, responsive, and serious about results. Highly recommend.”

— Marcus T., Houston, TX

“From credit repair to business coaching, Prolific Dynasty Enterprise is the real deal. I was drowning in bad credit and now I’m getting offers I never thought possible. Their team is honest, knowledgeable, and really cares about your success.”

— Danielle M., Atlanta, GA

.png)